- Zero borrowing inspections

- Quicker focus covered the life span of your financing

- Maintain your latest interest

- No large closing costs associated with the refinancing

- No a long time software techniques

- Not offered by all the loan providers

- Unavailable for all financial designs

- Need create at least lump-contribution fee reduced amount of the principal

Figuring mortgage recast

Ahead of provided mortgage recasting, it is a smart idea to assess how recasting will be different your month-to-month home loan repayments. Many web sites offer financial recast calculators that allow you to strike from the wide variety and determine your payment per month. But not, figuring it yourself is achievable. You start from the figuring out your existing principal kept on the home loan. Subtract the amount of your lump-sum percentage to grant a different principal balance. Up coming, utilizing the conditions and you can interest rate of your newest mortgage, influence the new payment.

For example, for those who have a 30-year repaired financial with an equilibrium regarding $2 hundred,000 and you may an interest rate away from 4.99%. Your current payment is $step 1,072. If one makes a lump sum payment regarding $40,000, so it will bring your dominating right down to $160,000, reducing your monthly payment to $871.

Whether you have been in some money or decided to dip for the discounts, and make a huge lump-contribution payment and recasting your own mortgage will save you profit focus repayments across the overall, and reduce your monthly costs. At Champion Household Applications, we all know one recasting or refinancing can appear challenging getting borrowers. All of us will be here to answer all your valuable inquiries which help you will find the fresh refinancing or recasting choice you to definitely is best suited for your requires. To learn more about the way we might help, plan a visit with us now.

Home financing recast is when a debtor can make a large, lump-share percentage on the main of its mortgage, resulting in that loan reduction you to reflects new equilibrium. Let’s take a closer look from the what a mortgage recast is actually and title loan Maine how it truly does work so you can determine if it makes sense to suit your situation.

Definition and Exemplory instance of a home loan Recast

A home loan recast occurs when your bank recalculates the new monthly money in your loan according to the a great balance and you will left title. Usually, when you are considering recasting their financial, possible put down a lump sum of cash into the principal. If you find yourself their interest rate and identity will continue to be the same, the lending company will likely then calculate an alternate monthly payment according to the reduced equilibrium.

- Solution term: Re-amortization

What if their completely new home loan is getting $200,000. You has just obtained a bonus in the office and decide to expend an extra $15,000 to your the principal. You will be today on the right track to repay your mortgage in the course of time which have an equivalent payment amount. When you’re looking for a lesser monthly payment, not, you might ask your lender to recast your debts along side remainder of your loan.

Just how home financing Recast Functions

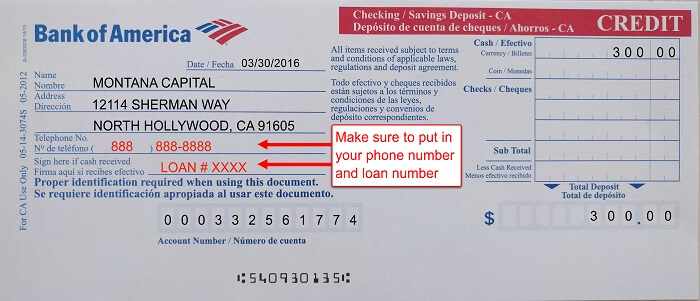

After you pick you’d like a home loan recast, contact your bank to ascertain if or not a mortgage recast is achievable. When it is, ask them regarding the lowest count you ought to lay out, next meticulously complete the mortgage recast application from your own financial and make your lump-share commission.

Their financial will then reconstitute their payment schedule on remainder of one’s financing label to account fully for the brand new swelling-contribution payment. The expression plus interest will continue to be an identical, however your monthly installments could well be down.

Home loan recasts are merely having conventional loans. When you yourself have a national-supported financial including an FHA, Va, otherwise USDA mortgage, it won’t qualify for an effective recast.